[ad_1]

The Divergent Bar might help decide the potential transfer of 1 (or probably as much as 3) bars into the longer term. It’s a instrument used to establish if you will notice a possible greater excessive or decrease low inside the subsequent three bars. Relying on the time-frame, you should use this instrument to make for some nice quick time period trades that you could be solely maintain in a single day, and even long term swing setups. The general win price utilizing my In a single day Revenue Technique with this indicator continues to stay above 80%.

There are two sorts of divergent bars, the bullish divergent bar and the bearish divergent bar.

1. Bullish Divergent Bar: A bullish divergent bar indicators a possible transfer to a better excessive in comparison with the excessive of the bar forming the bullish divergent bar. This greater excessive usually occurs inside the subsequent bar, however can take as much as 3 bars to comply with by on the sign. For instance, for a bullish divergent bar, we are going to usually see some type of greater excessive inside the subsequent 3 bars in comparison with the bar that printed. Because of this I usually like to present myself a while within the expiration to permit for these three bars to print. On a every day chart, this implies wait to see a better excessive inside the subsequent 3 days, to permit the commerce to comply with by.

2. Bearish Divergent Bar: Alternatively, a bearish divergent bar indicators a possible transfer to a decrease low in comparison with the low of the bar forming the Bearish Divergent Bar. This decrease low usually occurs inside the subsequent bar, however can take as much as 3 bars to comply with by on the sign. In a bearish divergent bar, we are going to usually see a decrease low inside the subsequent 3 bars in comparison with the one which printed. For instance, it might take as much as 3 hours on an intraday hourly chart for the sign to comply with by.

I’ve discovered that in Bullish Traits, Bearish divergent bars grow to be a counter development sign and due to this fact can have a smaller likelihood of following by on the decrease low. Every time I see a Bearish Divergent Bar in a Bullish Development, I usually use it as an indication to contemplate taking earnings, or to maintain an in depth eye on a possible transfer again into help for me to leap again in with a bullish commerce once more matching with the development.

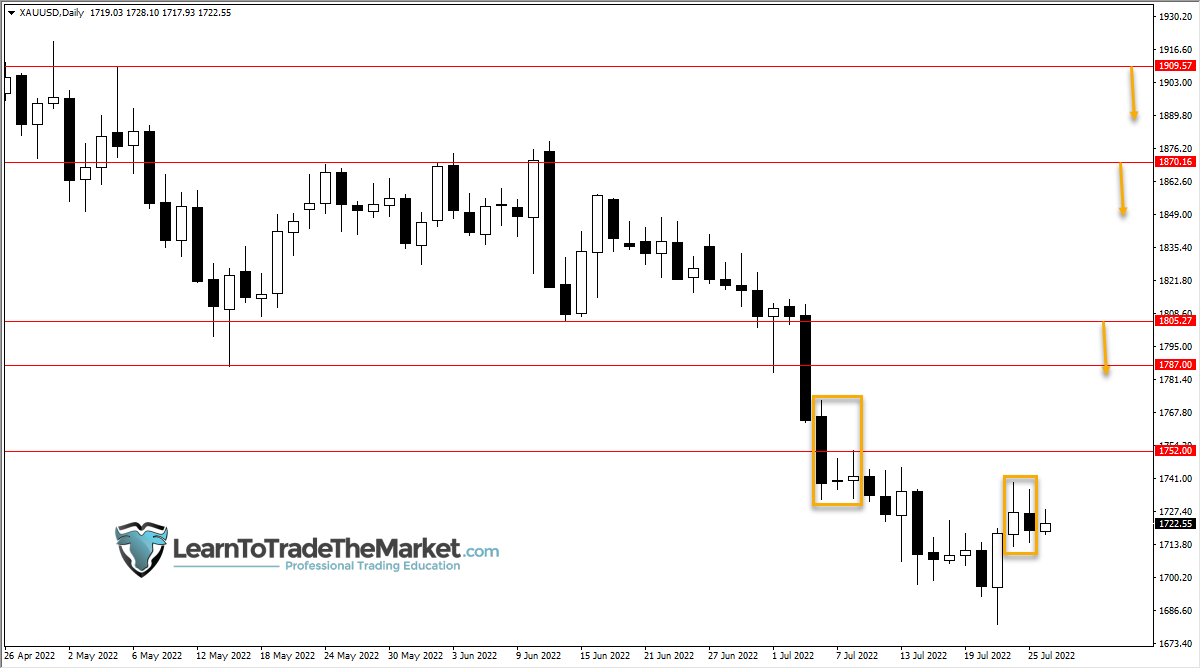

Consolidation: If a divergent bar prints again to again, whether or not it’s a bearish and bullish divergent bar or two bearish and two bullish bars, this may begin to be an total signal of consolidation. It doesn’t imply the sign is not going to comply with by, nonetheless it won’t be as dramatic of a comply with by for a better excessive or decrease low.

Within the instance, you’ll be able to see within the center field that it took 3 bars, or 3 days, to comply with by and print a decrease low, exhibiting how it’s important to be affected person. The indicators technically adopted by however it wasn’t a really robust decrease low and was a much less dramatic transfer. Nevertheless, it won’t all the time be as dramatic. It simply hints at an total signal of consolidation.

When you determine to take a commerce off a divergent bar throughout consolidation, there are two issues you’ll be able to think about.

1. The very first thing to contemplate is your Threat. You could look to carry a smaller capital danger within the commerce, in case it doesn’t comply with by or will not be as dramatic of a better excessive or decrease low.

2. The opposite factor to contemplate is your Worth Goal. Contemplate taking a smaller value goal with a decrease good ‘until cancel (GTC). This will increase the likelihood that the commerce will fill and you’ll nonetheless take a fast revenue. That’s why you’ll see in my examples, I’m solely a 15 or 20 cent revenue. It will not be the most important revenue, however throughout that point on an intraday transfer, I’ve protected my preliminary capital danger utterly, I’ve nonetheless managed to lock in a small revenue, and I nonetheless have a butterfly commerce left that I’ll both money settle into the shut that day, or can shut out the subsequent day, ideally taking that revenue on the commerce itself.

3. Additionally think about doing methods that profit from chop, like credit score vertical spreads, or unbalanced butterflies. This is usually a nice commerce setup if the divergent bar doesn’t essentially see a robust comply with by. So long as the quick strike stays out of the cash, you’ll be able to usually take a revenue.

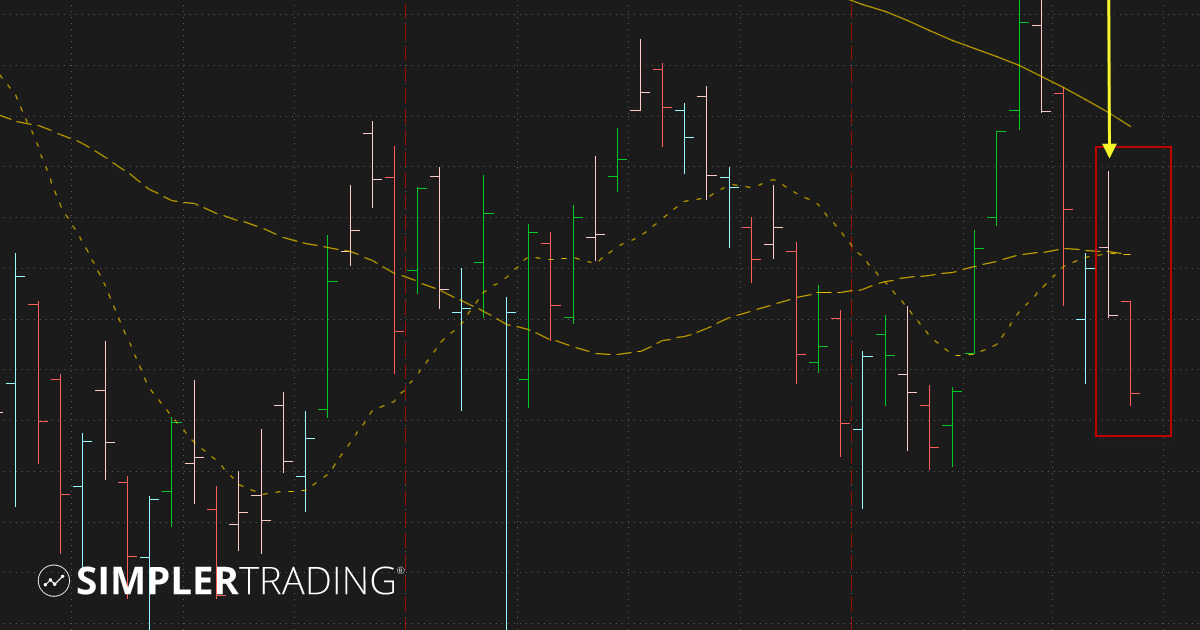

Methods to Learn a Divergent Bar: The divergent bar indicator provides a transparent sign of a bullish or bearish divergent bar simply by a change within the bar’s coloration. You’ll be able to customise the colour for the bullish divergent bar and bearish divergent bar to no matter colours you prefer to. I selected the sunshine pink to signify a bearish divergent bar and a cyan blue to signify a bullish divergent bar. That’s what works greatest for me psychologically to find out which is a bullish versus bearish divergent bar.

Which period frames does the Divergent Bar work on? The divergent bar indicator can be utilized on any timeframe. It may be used from an intraday timeframe all the best way to a month-to-month timeframe. Relying on the buying and selling technique I’m utilizing, I’ll use the bar on completely different time frames.

Right here’s an instance of SPX on an hourly intraday chart:

The Divergent Bar indicator solely wants knowledge of the prior bar and the present bar to kind a correct sign. This can be a nice profit to symbols who’ve had current IPOs. When you needed to commerce Draft King or BeyondMe once they first began to commerce, this could be a fantastic indicator to make use of as a result of the indicator doesn’t take a variety of time or knowledge to print a sign. As a substitute of ready on extra buying and selling knowledge to begin printing legitimate indicators on different indicators, the Divergent Bar indicator can begin providing you with indicators the very subsequent day. So in case you are on an hourly chart, after the primary hour of buying and selling, it might probably print indicators for you.

You need to use the divergent bar on any kind of bar. Personally, I take advantage of the usual bar. When you desire the candlestick bar, it could work on that as effectively. When you use one other indicator that prints on the bar, just like the GRAB Candle or the 10x bars, then the divergent bar indicator would possibly battle with it and never print a correct sign. Nevertheless, an effective way to get round that is to create a grid chart. One chart can embrace the Seize Candles or 10x bars, whereas the opposite chart can maintain the Divergent Bar Indicator. That means you’ll be able to watch each indicators, and have them each be legitimate and never cancel one another out.

Tip: If the divergent bar’s excessive (for a bullish divergent bar) and low (for a bearish divergent bar) is working proper right into a degree of Resistance or Assist and also you’re on the lookout for the underlying value to interrupt that degree to ensure that the sign to comply with by, then it might need a tougher probability of doing so. So for those who take the sign, take into accout to be cautious of it not having a robust comply with by as a result of the resistance (or help) would possibly win the battle and never let the underlying value comply with by all the best way on the divergent bar sign. At different occasions, when the divergent bar matches with testing Assist or Resistance, it could make for a stronger sign and potential transfer. That’s why I like bullish divergent bars off of help ranges in bullish developments.

I wish to name the Divergent Bar my Batman and the Compound Breakout Software its Robin. Regardless that this indicator works nice by itself, it could nonetheless assist to have its sidekick to assist solidify the sign and make for higher entries with greater chances of understanding. To be taught extra in regards to the Compound Breakout Software, go to… https://www.simplertrading.com/compound-breakout-tool/

Due to my trusty Divergent Bar Indicator, I’ve been capable of higher acknowledge when costs are shifting up greater or down decrease. When you’re fascinated with studying extra in regards to the Divergent Bar Indicator and the best way to add this indicator to your toolbox of methods, go to https://www.simplertrading.com/divergent-bar-indicator

As all the time my fellow merchants, might the commerce be with you!

[ad_2]

Source link