[ad_1]

Click on right here to get a PDF of this publish

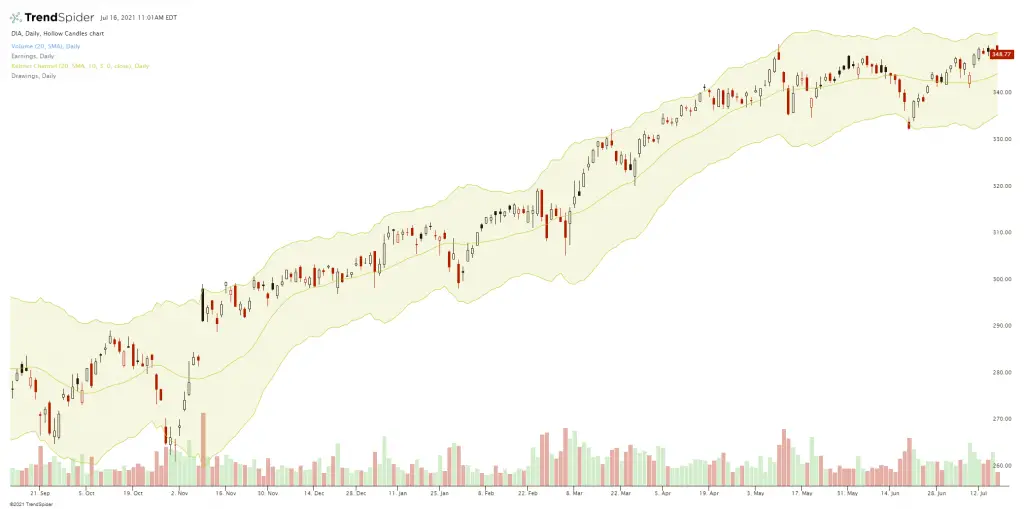

Keltner Channels is a technical indicator proven visually as envelopes expressing the deviation in Common True Vary on a chart each above and under an exponential transferring common. It is extremely comparable in precept to Bollinger Bands, which use customary deviations from a transferring common to quantify the bands. The distinction is that Keltner Channels use ATR versus customary deviations to quantify the gap of worth from the transferring common.

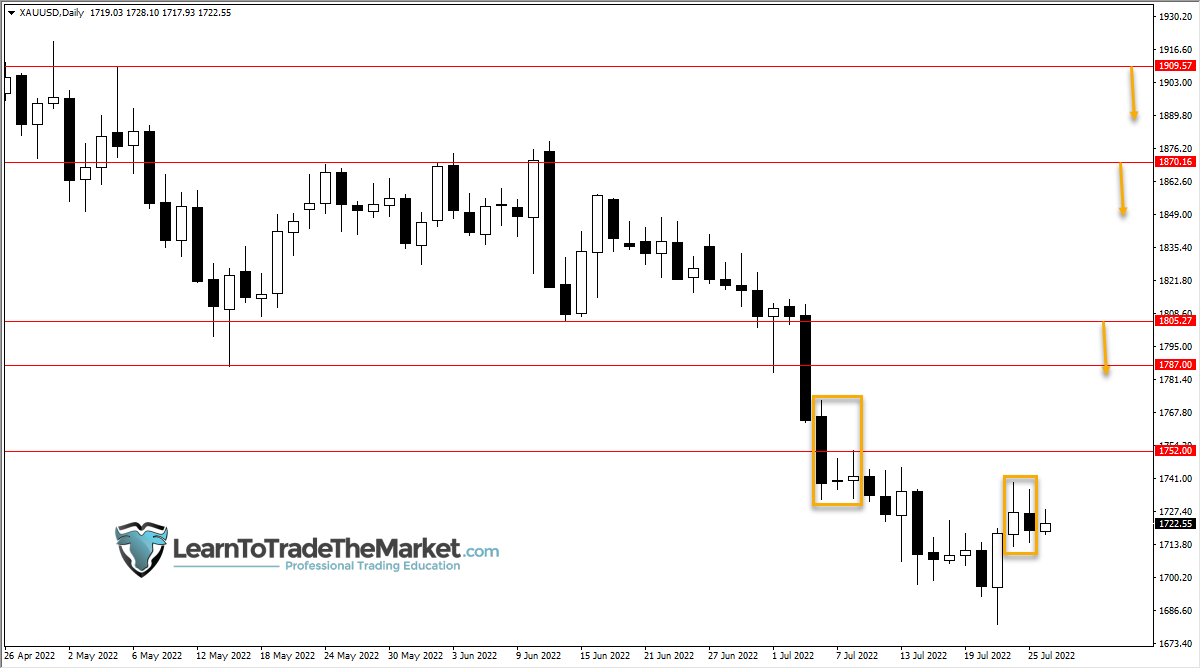

Keltner channels default setting is 2 ATRs each above and under the 20-day EMA. The course of the exponential transferring common quantifies development course as inclining is up and declining is down whereas the ATR channel width specific the volatility on the chart. Keltner Channels can each establish the general development on the chart and likewise present areas with a excessive likelihood of reversal. Channel breakouts over or beneath 2 ATRs can at occasions sign a robust development, nonetheless breakouts from 3 ATR channels fail nearly all of the time. Keltner Channels establish overbought and oversold ranges on the higher and decrease boundaries when a market goes sideways inside a spread.

Keltner Channels are calculated be choosing the time-frame size for the exponential transferring common and likewise selecting the time intervals for the Common True Vary and the multiplier used for the Common True Vary.

The most well-liked default setting is:

The 20-day exponential transferring common as the center line.

20-day EMA + (2 x ATR(10)) because the higher channel line.

20-day EMA – (2 x ATR(10)) because the decrease channel line.

Most buying and selling platforms fill the house between the higher and decrease channel strains with a coloured cloud background to simply see the vary.

Chart Courtesy of TrendSpider.com

I choose the three ATR setting for the channel strains as I’ve discovered it to seize rather more of the value motion strikes inside this wider channel boundary than the default 2 ATRs.

Ihe 20-day exponential transferring common as the center line.

20-day EMA + (3 x ATR(10)) because the higher channel line.

20-day EMA – (3 x ATR(10)) because the decrease channel line.

Chart Courtesy of TrendSpider.com

That is the fashionable model of Keltner channels a lot totally different than the unique dynamics. Linda Bradford Raschke created the newer model of Keltner Channels again within the Eighties. This new model modified to make use of a volatility based mostly indicator, Common True Vary (ATR) for channel width.[1]

[ad_2]

Source link