[ad_1]

Shale Oil & Gasoline updates

Signal as much as myFT Every day Digest to be the primary to learn about Shale Oil & Gasoline information.

A wave of dealmaking in America’s shale patch is intensifying, wiping out weak gamers and leaving the once-fractured sector within the arms of a brand new breed of “tremendous independents”.

Greater than $30bn in oil and gasoline offers have been accomplished within the second quarter and analysts and bankers anticipate the run of dealmaking to proceed. Traders are pushing shale producers to bulk up within the hopes that bigger gamers will rein in rampant provide development, ship higher returns and clear up the business’s operations amid mounting environmental pressures.

“Now we have means too many gamers within the sector which might be means too undercapitalised and too small to drive the efficiencies and returns that buyers want, so we’ll proceed to see consolidation occur,” stated Stephen Trauber, a vice-chair and veteran power banker at Citi.

“For those who’re under a $10bn market cap, it’s going to be arduous so that you can maintain your self long run,” he added.

Solely a handful of shale specialists are in that $10bn membership at present, together with bigger producers ConocoPhillips, EOG Sources and Pioneer Pure Sources. Under them is a nonetheless deeply fractured company panorama with dozens of smaller non-public and publicly held producers which have carved up the nation’s largest oilfields, ensuing, analysts say, in persistent oversupply and excessive prices.

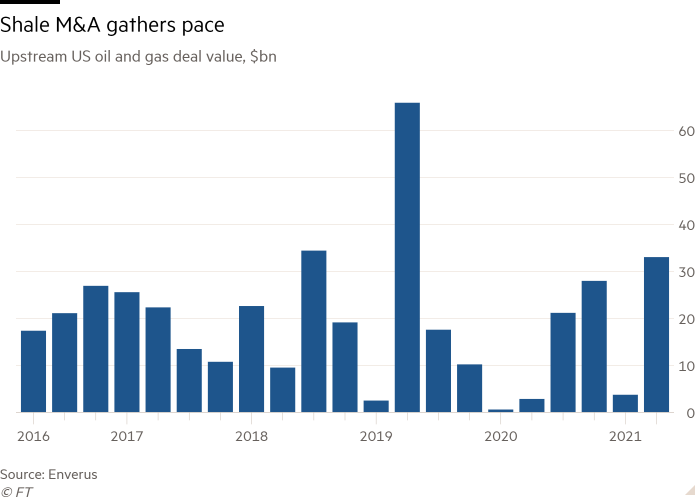

The $33bn in offers within the second quarter was the best quarterly whole because the second quarter of 2019, when Occidental Petroleum purchased Anadarko for $55bn, in accordance with information from Enverus, an business consultancy. There was greater than $85bn in offers over the previous 12 months because the sector has emerged from a pandemic-driven crash that decimated its funds.

Andrew Dittmar, lead M&A analyst at Enverus, stated all of the “driving elements” behind the latest wave of offers have been nonetheless in place and that shale producers had “prioritised consolidation” because the sector regarded to attract buyers again to the sector.

He added that public corporations had not too long ago turned their consideration to purchasing non-public equity-backed producers. In April, Pioneer Pure Sources purchased DoublePoint Vitality, backed by Houston-based power funding agency Quantum Vitality Companions, for $6.4bn within the largest such deal.

Scott Sheffield, Pioneer’s chief govt, stated on the time that the deal, which made his firm the biggest producer within the prolific Permian oilfield in Texas, would ship “vital advantages of scale” whereas the corporate deliberate to tame DoublePoint’s fast development.

Non-public fairness teams pumped tens of billions of {dollars} into the shale sector throughout its increase years within the early and mid-2010s. However many have discovered it tough to exit their positions, particularly as public markets soured on the business, which has generated hefty losses for shareholders.

“Pulling off an IPO is exceptionally arduous, we’ve seen one within the final 5 years,” stated Dittmar of Enverus. “Even they struggled out of the gate so there’s not a number of welcome in fairness markets for brand new corporations.”

The latest rise in US crude costs to about $70 a barrel is a doubtlessly enticing exit level for personal corporations, analysts say. That is particularly in order a lot of these energy-focused non-public fairness retailers are shifting their focus to low-carbon applied sciences, the place markets are booming in what many see as an echo of the shale frenzy just a few years in the past.

“Non-public fairness is doing certainly one of two issues,” stated Trauber of Citi. “Both merging amongst themselves to get larger to in the end promote to a giant public firm, or promoting on to a public firm, if they’ve the standard and measurement now.”

Rising regulatory and investor calls for for oil and gasoline producers to slash their emissions can be anticipated to gas the business’s consolidation as bigger corporations have extra monetary capability to put money into air pollution mitigation. A Dallas Federal Reserve survey late final 12 months discovered that simply 10 per cent of smaller corporations had a plan to chop their carbon emissions, whereas 50 per cent of their larger rivals did.

Whereas inexperienced pressures push some shale corporations to merge, analysts say the US supermajors ExxonMobil and Chevron are anticipated to stay on the sidelines for now.

Each corporations misplaced main climate-focused shareholder votes earlier this 12 months and are underneath stress to step up investments in low-carbon applied sciences. Doing a significant shale deal now would ship the “unsuitable sign”, stated one power banker.

Nonetheless, there are many giant independents that wish to set themselves up for the lengthy haul, which suggests getting larger. “We’re headed in the direction of a extra consolidated business,” stated Dittmar. “It’s only a matter of the pacing that we get there.”

Twice weekly e-newsletter

Vitality is the world’s indispensable enterprise and Vitality Supply is its e-newsletter. Each Tuesday and Thursday, direct to your inbox, Vitality Supply brings you important information, forward-thinking evaluation and insider intelligence. Enroll right here.

[ad_2]

Source link