[ad_1]

MicroStockHub

In arguably an important week for Wall Road this summer season, with the Fed choice and GDP on faucet, earnings may truly find yourself figuring out route.

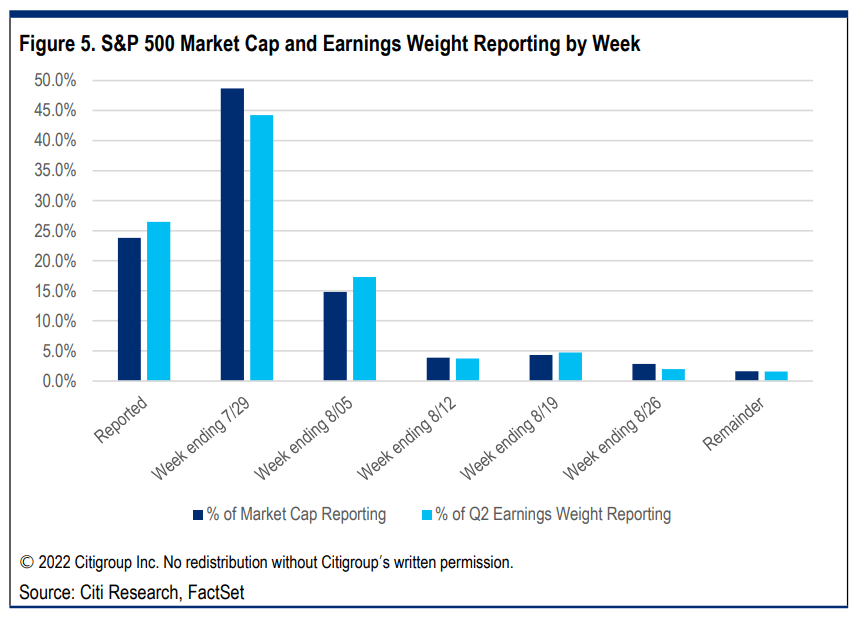

There are 175 S&P 500 (SP500) (NYSEARCA:SPY) firms set to report Q2 outcomes, together with 12 Dow (DJI) (DIA) parts. Large names on this week’s the calendar embrace McDonald’s (MCD), ExxonMobil (XOM), Ford (F) and the remainder of the megacaps: Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Meta (META) and Alphabet (GOOG) (GOOGL).

So far, outcomes have been beneath par. Of the 21% of S&P firms reporting, 68% have topped expectations. That is beneath the five-year common of 77%, in accordance with FactSet. The typical beat of three.6% is shy of the 8.8% common. The earnings gorwth charge of 4.8% is enhancing, however can be the bottom since This fall 2020. The 65% of firms beating on the highest line is beneath the typical of 69%.

Nonetheless, the S&P is up 7% for the reason that reporting interval began and Citi says outcomes are exhibiting “resilience” that can push the broader market greater within the second half of the 12 months.

The place to look: It is very important dig into earnings on a sector degree and keep in mind the focus of income within the large names.

Up to now, optimistic surprises “have been the norm in most sectors,” Citi strategist Scott Chronert wrote in a notice.

Buyers “must look extra deeply at sector contributions to index earnings to higher perceive how recession threat might play into the earnings image,” Chronert mentioned “As well as, it’s important to acknowledge focus within the largest earnings contributors when assessing index earnings.”

“The highest 20 shares by earnings contribution are anticipated to find out 35% of Q2 index earnings, whereas the highest 50 comprise 53% of index earnings. The early takeaway is that earnings surprises are operating stronger for the highest 100 earnings contributors than the ‘backside 400’. Apparently, per this information, the earnings focus among the many prime 100 shares is over twice that of the following 400.”

Outlook: Citi says earnings expectations for 2023 look optimistic, however “there could also be extra earnings resilience in a gentle recession situation than generally anticipated” and whereas “earnings cuts are broadly anticipated, they should be weighed relative to the valuation compression which has already occurred.”

“In wanting on the previous week’s motion in response to early earnings experiences, we level out that expectations have doubtless soured to the purpose the place ‘much less dangerous than feared’ outcomes can set off a optimistic market response,” Chronert mentioned.

MKM strategist Michael Darda says equities can keep away from a second leg down this 12 months, even when there’s an impending earnings collapse.

“In different phrases, we may have two bear markets (the primary half of 2022 and once more someday in 2023 if there’s a recession subsequent 12 months) with a big unanticipated bull market in between,” Darda mentioned. “There may be additionally the chance that the bear market already occurred and even when there’s a comparatively gentle recession this 12 months or subsequent 12 months, fairness markets shall be supported by decrease low cost charges and the anticipation of an (eventual) restoration.”

See the SA earnings calendar.

[ad_2]

Source link