[ad_1]

The tides but once more shifted within the US inventory market this previous week.

Shares rallied all week and now all of the bulls are taking a victory lap whereas the bears swear up and down that it’s a bear market rally.

Listed here are the US indices returns for the week:

- S&P 500: +5.5%

- NASDAQ 100: +7.23%

- Dow Jones Industrial Common: +4.6%

- Russell 2000: 7.6%

The Technical View: Shares

From a technical perspective, the downtrend sample within the S&P 500 is formally damaged and we’ve now entered range-bound territory.

After the current value motion, most would count on a direct shift to an upward development, or a development reversal. However in actuality, when a development dies out as this one did (slightly than die a climactic loss of life), they have an inclination to ‘relaxation’ and commerce in a variety for a bit earlier than choosing its subsequent path.

This can be a elementary precept of a number of the most profitable merchants: that markets undergo durations of vary enlargement and vary contraction. Now that the market has reached some semblance of equilibrium, a minimum of in comparison with current historical past, don’t be shocked to get up to a boring marketplace for the subsequent few weeks.

As a result of bears are the loudest and most assured of their proclamations, one of many prevailing narratives is that the present bullish value motion in inventory is a basic “bear market rally.” That might very nicely be true, however there’s just a few causes to not be offered simply but.

First off, we’re solely about 15% off all-time-highs on the present value ranges after about seven months of downward traits. That’s hardly a convincing bear market and will extra precisely be known as an extended correction.

Moreover, in the event you have a look underneath the market’s hood, issues don’t look as unhealthy as they’re made to look. What rallies out of a downtrend is sort of telling. Whereas in the course of the “reflation” period of the inventory market in 2021, tons of defensive and worth shares outperformed on market rallies.

Throughout this rally, we’re seeing vital outperformance from pro-cyclicals like expertise, shopper cyclicals, in addition to small caps exhibiting relative energy towards mega-caps as could be seen within the Russell 2000 vs. the Dow.

And the last word gauge for risk-on urge for food in equities, ARK Innovation ETF (ARKK), is exhibiting regular relative energy to the S&P 500, which, to me, is a surefire signal that we’re not in a bear market.

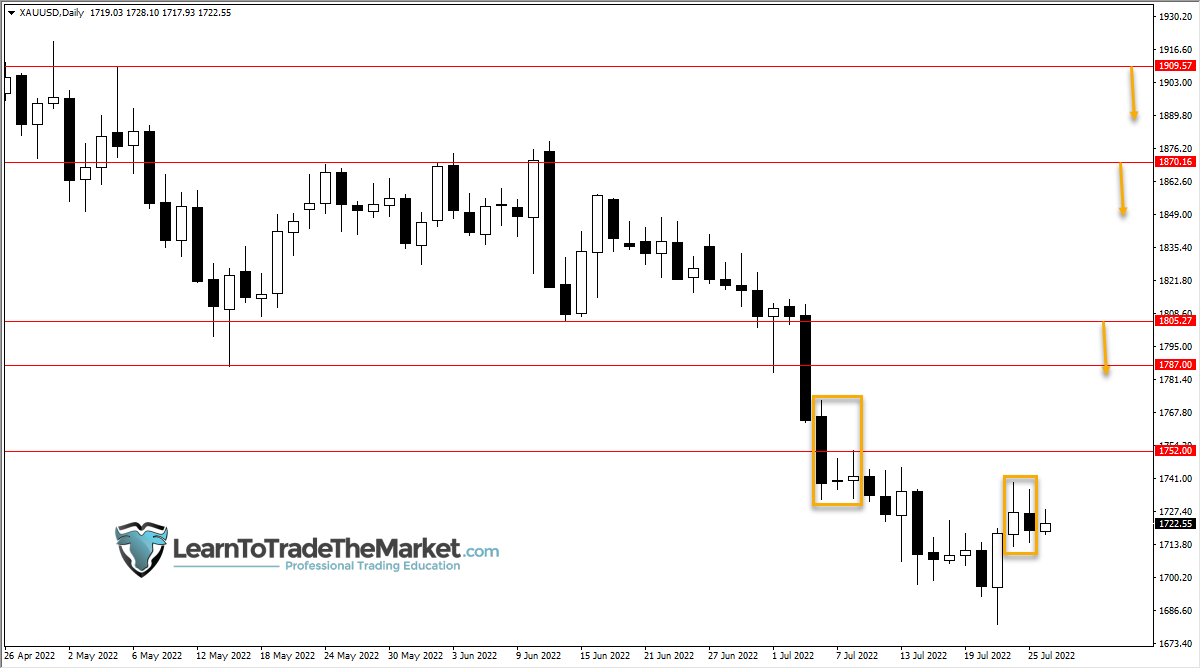

The Technical View: Crude Oil

With regards to crude oil, we’re as soon as once more approaching the essential finish of the multi-month vary.

Again in June when crude examined the highest finish of this vary and tried to interrupt out, value rejection shortly occurred, sending the worth again within the vary and starting a month-long downtrend which continues to be underway.

Crucially, crude oil is down trending into this vital backside finish of the vary, considerably elevating the chances that the extent is damaged.

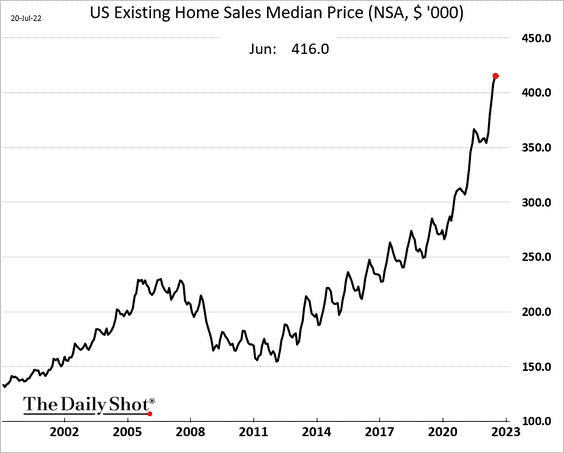

Chart of the Week: House Costs

Look, the housing market isn’t as robust because it was six months in the past. Mortgage charges are quickly climbing, there’s value cuts throughout the board, and stock is sitting available on the market for much longer particularly within the beforehand robust markets like Austin, TX.

Nonetheless, the median US dwelling value simply hit an all-time excessive. If we’re to enter a recession within the subsequent two quarters, count on rather more ache within the housing market.

Federal Reserve Watch

This coming Wednesday we get a really consequential Fed assembly. One which merchants are betting can be a minimum of 75 foundation factors, if not 100 foundation factors.

With just a few financial surprises in current weeks like the new job report, the new inflation report, and the stunning Financial institution of America card spending information, which confirmed shoppers aren’t spending like there’s a recession, there can be plenty of stress on the Fed to be much more hawkish than recently.

Powell is probably going feeling immense stress to make a press release. To beat the market into submission with hawkishness.

However alternatively, it comes proper as there appears to be gentle on the opposite finish of the tunnel. It’s very seemingly that the subsequent CPI print can be a lot decrease than the June print, given the numerous declines in commodity costs as of late. A meaningfully decrease print may give Powell the assist to chill out on the speed hikes.

Presently the market is pricing in a 73% probability of a 75bp hike, and a 27% probability of a 100bp hike:

Final Week’s Information

- Snap (SNAP) reported ugly earnings and the inventory dropped 27%. The corporate additionally suspended their steerage. They did, nevertheless, outperform new person expectations and provoke a $500M buyback program.

- As traditional, the rally in hashish shares was a “promote the information” occasion, as they declined on information of laws being launched to the US Senate.

- Russia and Ukraine plan to signal a deal to start out exporting grains and fertilizer out of the Black Sea once more

- The decide chosen within the Twitter vs. Musk case is Kathaleen McCormick, which is notable as a result of she pressured a reluctant purchaser to shut a merger deal, a uncommon prevalence in Delaware court docket.

- Choose in Twitter/Musk case grants Twitter’s request for an expedited trial

- Amazon (AMZN) is utilizing Rivian (RIVN) vans to ship packages in choose metro areas.

- Russia restarts Nord Stream pipeline, gasoline flows to Europe once more after a 10-day shutdown

- Tech hiring pause continues this week with new pauses at Microsoft and Google

- Netflix (NFLX) beats earnings and the inventory has rallied practically 30% from current lows.

- Financial institution of America card spending information reveals shoppers are nonetheless aggressively spending particularly on journey.

Upcoming Earnings Subsequent Week

The inventory market was helped final week by just a few giants like Netflix (NFLX) and Tesla (TSLA) reporting optimistic earnings, which is being seen as an indicator for the remainder of the market.

Up to now, 70% of firms have beat EPS expectations, which is down from 76% final quarter, nevertheless given the baked-in bearish expectations, the market appears fairly pleased with the earnings outcomes thus far.

Subsequent week is the week of the FANGs. We get Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), and Microsoft multi function week. As well as, we get dozens and dozens of large-caps and mega-caps, with an enormous portion of the Dow 30 reporting.

Subsequent week’s reviews will seemingly decide the path of the marketplace for the subsequent few months.

Listed here are probably the most vital earnings reviews coming this week. As a result of there’s a lot reporting, we’re simply providing you with probably the most notable and doubtlessly risky reviews. Checkout an earnings calendar for a extra exhaustive record:

Monday, July 25:

- Newmont (NEM)

- Koninklijke Philips (PHG)

- RPM Worldwide (RPM)

- SquareSpace (SQSP)

- NXP Semiconductors (NXPI)

- Cadence Design Programs (CDNS)

- Packaging Corp of America (PKG)

- Whirlpool (WHR)

Tuesday, July 26:

- Coca-Cola (KO)

- McDonald’s (MCD)

- Microsoft (MSFT)

- Alphabet (GOOG)

- Visa (V)

- Texas Devices (TXN)

- Chipotle (CMG)

- Enphase Power (ENPH)

- Moody’s Corp (MCO)

- United Parcel Service (UPS)

- Raytheon Applied sciences (RTX)

- 3M (MMM)

- Basic Electrical (GE)

- UBS Group (UBS)

- MSCI (MSCI)

- NVR (NVR)

Wednesday, July 27:

- Meta Platforms (META)

- Qualcomm (QCOM)

- Ford Motor (F)

- Etsy (ETSY)

- T-Cell (TMUS)

- Bristol Myers Squibb (BMY)

- Boeing (BA)

- ADP (ADP)

- CME Group (CME)

- Sherwin Williams (SHW)

- Shopify (SHOP)

- Kraft Heinz (KHC)

- Hess Corp (HES)

- Spotify (SPOT)

Thursday, July 28:

- Apple (AAPL)

- Amazon (AMZN)

- Intel (INTC)

- Mastercard (MA)

- Pfizer (PFE)

- Merck (MRK)

- Comcast (CMCSA)

- Honeywell (HON)

- Anheuser-Busch (BUD)

- Altria (MO)

- Keurig Dr Pepper (KDP)

- Hershey (HSY)

- Southwest Airways (LUV)

Friday, July 29:

- Exxon Mobil (XOM)

- Procter & Gamble (PG)

- Chevron (CVX)

- AbbVie (ABBV)

- AstraZeneca (AZN)

- CBOE International Markets (CBOE)

Upcoming Financial Knowledge Subsequent Week

Tuesday, July 26:

- S&P Case Shiller Nationwide House Value Index (YoY)

- Client confidence index

- New House Gross sales

Wednesday, July 27:

- Federal Reserve assembly

- Pending dwelling gross sales

Thursday, July 28:

- GDP, first launch

- Preliminary and persevering with claims

- PCE inflation report

- Client spending

- Chicago PMI

- College of Michigan Client Sentiment Index

[ad_2]

Source link