[ad_1]

All proper, so on this episode we’re going to speak about gaps and home windows on each each day charts and intraday charts.

Get the Micro Pullback Technique PDF obtain and extra free items right here

This once more is one other episode on this multi-part collection on technical evaluation and methods to learn inventory charts, particularly for day buying and selling. However once more, not unique to day buying and selling. When you’re a short-term investor or swing buying and selling, you may actually apply gaps and home windows to these methods as nicely as a result of we’re going to speak fairly a bit about each day charts.

Now, a reminder as all the time, these ranges are important they usually work nicely as a result of so many merchants respect this language of technical evaluation. Because of this you’re studying this language as a result of there are very clear purchase and promote indicators on the technical evaluation contained in the charts. And for those who’re lacking them, you’re each lacking alternatives and probably positioning your self to stroll proper right into a promote sign with out realizing it, and that may be a fast and pointless loss.

So let’s discuss first about how a niche is shaped. So gaps are quite common on each day charts of shares and the best way they’re shaped, and I’ll change to the whiteboard right here is by a inventory buying and selling in the future. I’ll simply draw like a bunch of days right here. Let’s simply fake these are common candlesticks. After which the following day the inventory has horrible information and it opens down right here. So the hole on the chart is from right here to right here.

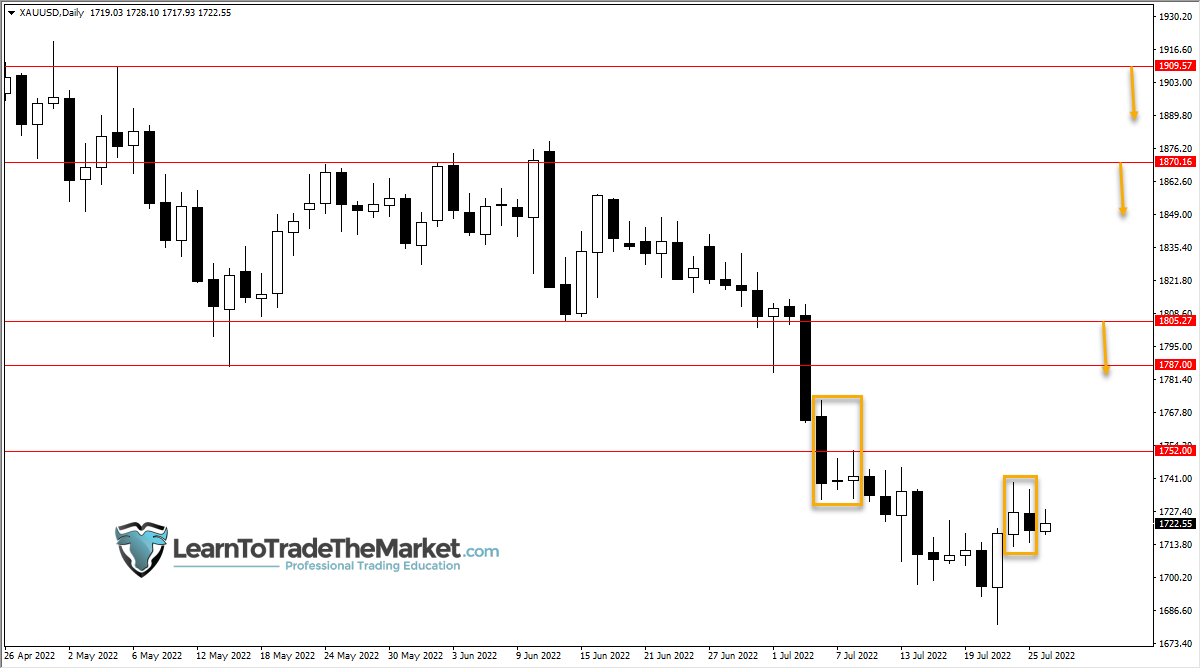

Now, technically every one in every of these ranges if it opened greater than the day before today is a niche. So a niche is I’m opening greater or decrease than earlier day. We will have shares that hole up, we are able to have shares that hole down, however what finally ends up taking place on the each day chart throughout a niche, and you’ll see, that is an instance proper right here of a chart with the blue spotlight within the hole, the hole down, you have got this huge area.

And the best way I take a look at a niche like that is that that is an space the place you have got actually no resistance and also you don’t have any assist as a result of it simply broke by means of that entire space. So we’ve a method that’s known as hole fill. Now the hole fill technique is after we take a look at a inventory that’s gapped down after which begins coming again up right here, we take a look at this potential space from right here to right here. That is hole fill means up right here. In order it begins to interrupt into the hole, it has no resistance on a technical degree till this space right here, until you have got a degree corresponding to your 200 shifting common that’s going to cross within the center. And you probably have that, then that’s your first degree of resistance on the 200. When you can break by means of that, then you definately’ve bought room as much as right here and also you’ve bought hole fill.

So these are gaps on the each day chart. Gaps are extraordinarily frequent. Now what’s a bit bit totally different is when we’ve what are known as home windows. A window on the each day chart is when you have got, let’s see, so we’ll do that. So we’ll do a pair candles going up right here after which a pair candles. We’ll have one which drops down after which two extra proper right here. Okay, so now could be this inventory begins coming again up proper right here it has not a niche, however a window from right here till right here.

So this window is shaped by a really lengthy candle. So there’s when you’re into this space, you don’t have any resistance and no assist. I say that, however I’ll hesitate for one second as a result of it’s attainable that for those who appeared, it is a each day chart, for those who checked out this candle intraday on the five-minute, it’s attainable that inside this candle that there was a really excessive degree of assist perhaps midway by means of the candle earlier than it rolled over once more.

So now as we come again up on the each day chart, it’s going to appear like we do have room all the best way again as much as this degree right here. However for those who take a look at this on a five-minute degree, a five-minute timeframe, you may even see that we’re going to have attainable resistance right here. It’s additionally attainable similar to with the opposite instance, that we’d have a shifting common difficulty proper on this space, one thing like this, that we’d be operating right into a shifting common, which might create resistance.

So let’s change again over to our charts right here as a result of on this instance you may see how though we’ve a big hole, we’ve the 200 shifting common right here at 6.52, and we’ve one other shifting common right here, one other one right here, and one other one right here. So this finally ends up creating resistance on this chart and it actually finally ends up making it so it’s probably not that nice of a chart. Though you do have a niche, it’s not that nice of a chart.

That is one other instance of a chart that has a niche. It opened greater. And the hole I draw is the precise area the place there was by no means any value motion. Some folks may draw from the near the open, however I wouldn’t do this as a result of you have got the low and you’ve got the excessive right here. And so to me, this blue space is the precise hole. So if this inventory begins to return down, we’d look to see if it breaks this low, it has no assist till proper down right here, which provides you a bit hole space the place you might have a little bit of a free fall. The inventory might drop in a short time. Or if we’re buying and selling to the lengthy facet, we’re taking a look at shares the place if it comes again up proper by means of right here, for example, if it might get above this degree, we’ve hole fill as much as right here, which implies the inventory might transfer in a short time.

So whenever you mix gaps and home windows with what you already know for those who’ve been watching by means of this multi-part episode or multi-part collection on technical evaluation, you already learn about ascending and descending, and horizontal assist and resistance traces. And also you actually have already got most likely an understanding of multi candlestick patterns, corresponding to an ABC sample, a flat high breakout or a bull flag. So after we begin to mix all of those totally different parts to technical evaluation, that’s after we can begin to kind a very robust bias on a inventory. The explanations that we prefer it and that we’re bullish are the explanations that we don’t prefer it.

And once more, reminder, that such a evaluation is de facto solely legitimate on shares which can be experiencing a excessive degree of relative quantity, very excessive relative quantity. Sometimes the results of breaking information. Sometimes a inventory that’s actually common, is likely one of the main gainers on the day you’re buying and selling it. These are the shares which can be going to reply essentially the most clearly to those vital ranges.

A inventory with low relative quantity just isn’t going to actually commerce very clearly round these ranges. It most likely wouldn’t even get into the hole in any respect. It would come as much as it after which fade. It’s simply not going to have the momentum behind it to actually get into this degree. So that you may see, “Oh, we’ve bought hole fill potential,” however that potential most certainly not be realized for those who’re making use of such a evaluation to the unsuitable kind of shares.

So let’s return over to our chart right here and take a look at just a few extra examples. So that is an instance of a window. So the window right here goes from 8.77 all the best way as much as 19.50. In order that’s a really giant window. However as I mentioned, it’s attainable that in this candle in some unspecified time in the future throughout that day, that it may need had loads of assist round 12.50 or one thing like that earlier than promoting off. So then as this comes again up, we’d say, “We might have a problem round 12.50.”

Now the second line that I’ve drawn at 8.77, that is simply the underside of the world that’s the window, the underside of the window proper right here. So that you may look and say, “Oh, is that this going to be resistance?” And it may very well be as a result of as you come into both hole fill or a window, you may have some resistance there as merchants who could be in from a decrease degree would take revenue earlier than risking that it hits that degree and rejects, all proper?

So let’s take a look at one other instance right here. It is a inventory that has bought off fairly a bit, and it does have a variety of gaps and home windows because it comes again up. Nevertheless, as a result of we’ve this difficulty with our shifting averages right here, it doesn’t actually to me really feel like the kind of inventory that’s most likely going to open up in an enormous means. Most certainly you do have merchants which can be nonetheless underwater from this final transfer right here. And in order you come again up, you’re most likely going to run into resistance ranges as a few of these merchants are promoting their positions.

So simply for example, for those who have been somebody who purchased 10,000 shares at six after which it drops to 2 bucks, you may need added one other 20,000 shares at two to deliver your common price down to love $4. So if it comes again to 4, you may need an order simply to promote the entire thing breakeven, and never should take a 30, $40,000 loss on this commerce. In order you begin to come again up, you’re going to run into these partitions, that are sometimes bag holders with orders which can be already out to unwind the place. So it’s not as frequent that you simply’ll have that fast parabolic transfer because it breaks into a niche or a window as you’d on a inventory that’s simply considerably extra bullish.

That is one the place it has been at this low degree for fairly a while, it lastly breaks by means of and also you get virtually an ideal instance of hole fill. Now, these are the sorts of charts. Now we have so many examples of this that we undergo the place you see examples of hole fill, examples of home windows. However I simply wished to current sufficient to offer you an concept of what you have to begin on the lookout for for those who’re on the market doing your individual technical evaluation, and attempting to know these ranges.

Now, once more, this isn’t a method. That is simply serving to you study the language of technical evaluation. If you wish to study extra about technique, down under I’ll put a hyperlink within the description the place you may obtain my micro pullback PDF. All proper? So the micro pullback PDF is definitely a method doc and that outlines the technique that I commerce of shopping for micro pullbacks. As a result of what we frequently see is as a inventory squeezes up, if we’ve this huge window, it squeezes up proper right here, will get into that window, pops up, after which it pulls again only for a second earlier than ripping greater. In order that micro pullback is one in every of my favourite methods to purchase a powerful inventory.

And the best way I discover it’s on my Excessive of Day MOMO scanners. So I discover these shares on my scanners, it provides me notification, increase, increase, increase, this inventory is shifting up proper now. I do my due diligence, I see the each day potential, and I purchase the primary pullback for the following leg up. So take a look at the micro technique PDF if you wish to study a bit bit extra about technique.

And if you wish to maintain watching episodes on this collection on technical evaluation, I’d be thrilled to have you ever do this. So I hope you’re having fun with these. I hope you hit the thumbs up. I hope you’re subscribed to the channel and you’ll proceed on to the following episode. I’ll put a hyperlink proper right here to the following one and I’ll put a hyperlink to some of the common ones proper right here.

[ad_2]

Source link