[ad_1]

Click on right here to get a PDF of this publish

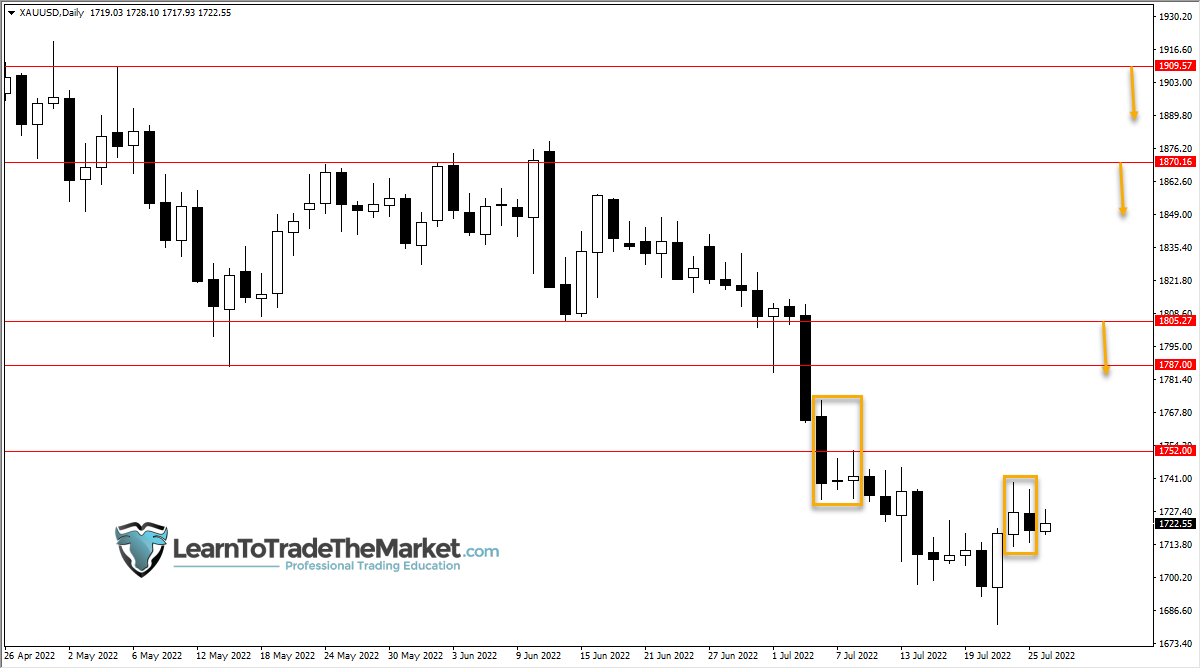

The downtrend definition is a transfer in value motion that makes decrease highs and decrease lows in the timeframe being tracked. A downtrend is brought about after a chart goes from a part of accumulation or vary buying and selling and right into a stage distribution. A distribution cycle generally is a mixture of quick sellers beginning to construct positions when they’re bearish and holders of lengthy positions exiting by promoting on the best way down and into rallies again to larger costs.

A downtrend can start after value resistance on chart has been reached and there aren’t any patrons at costs above that line. Downtrends are attributable to extra provide at decrease costs than there’s demand at larger costs. Promoting strain drives costs decrease as patrons usually are not prepared to purchase till value goes decrease. Every rally in a downtrend again larger is seen as a possibility by sellers to get out at larger short-term costs.

Image courtesy of @PriceinAction

Downtrends can be tracked by transferring averages that keep on one facet of a downward transfer in value. In downtrends, value motion will have a tendency to remain underneath the transferring common of the timeframe the downtrend is happening in. A value break above a transferring common can sign the top of a downtrend in that timeframe.

Chart courtesy of TrendSpider.com

A downward pattern is a standard incidence in all charts and markets and is part of the conventional cycle of accumulation, vary buying and selling, volatility and distribution. The tip of a downtrend can create new alternatives for oversold dip deep shopping for alternatives. Downtrends finish when provide at decrease costs is lastly exhausted and patrons begin transferring in for what they see as a possibility and begin bidding costs larger constantly.

[ad_2]

Source link