[ad_1]

Click on right here to get a PDF of this publish

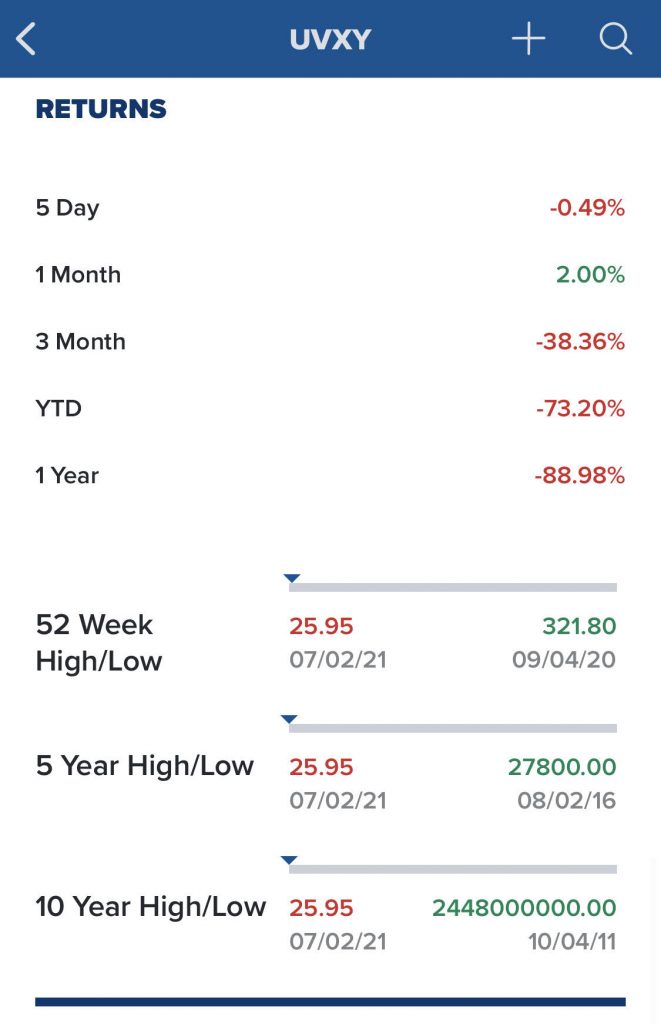

The UVXY is a volatility monitoring change traded fund. This ETF began buying and selling in October of 2011 and it tracks 1.5 occasions the efficiency of the S&P 500 VIX short-term futures index for a single day. Because of the compounding impact of day by day returns, the UVXY’s efficiency over the long-term will probably be very totally different than simply holding the VIX because of the impact of detrimental compounding inflicting deteriorating capital. Every time UVXY goes down -20% in a day it should return up +25% simply to get again to even and this has a detrimental impact on long run efficiency for a quick transferring ETF.

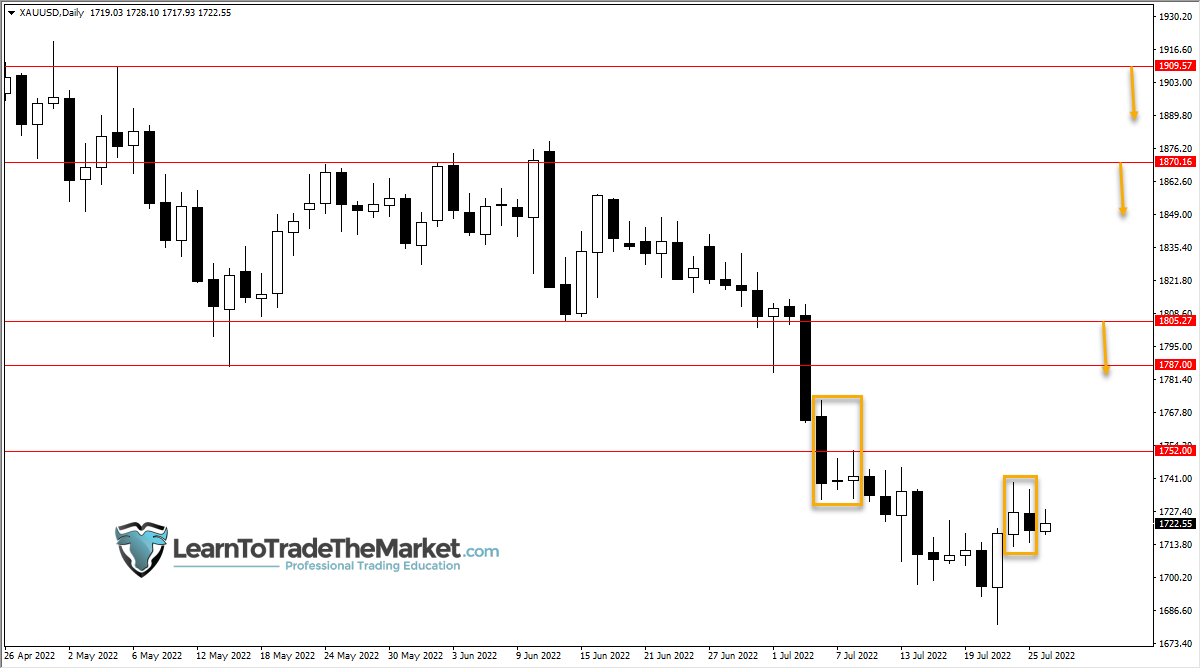

Because of the nature of the S&P 500 transferring from excessive volatility to low volatility in cycles mixed with leverage this ETF has simply been crushed decrease in worth over its historical past. It is a pure buying and selling automobile as any long run holds destroys capital. For instance, UVXY is already down -73.2% in 2021 thus far.

The perfect use of UVXY is for shorting it when it’s overbought with a decent cease loss for the uncommon events it does go on massive transfer greater throughout extraordinarily unstable market meltdowns. It may be an important buying and selling automobile to include into a brief facet biased pattern buying and selling or swing buying and selling system to catch massive strikes once they do happen. The UVXY typically tops close to the bottoms in inventory indexes together with bottoming close to the highest within the S&P 500 index and strikes primarily inverse to the inventory market.

UVXY does rally when volatility expands and may go up quick in a really extremely unstable markets like 2008 and March of 2020 however ultimately it does self destruct falling decrease very quick because the inventory market rallies off lows. Trying on the previous buying and selling vary of UVXY and its historic charts will be very eye opening. It’s potential to pattern commerce and swing commerce volatility itself and in addition profit from the destruction of capital in a leveraged ETF like UVXY with the appropriate means of chopping losses quick and letting winners run.

One other volatility ETF is the inverse SVXY which fits up +0.50% because the S&P 500 VIX short-term futures index goes down -1%. SVXY rises as volatility goes down so SVXY tends to pattern greater over time.

Rob F. Smith nicknamed $UVXY $UGLY an $SVXY $SEXY as a consequence of their traditionally efficiency.

Chart courtesy of TrendSpider.com

UVXY efficiency statistics:

(5 and ten 12 months costs are reverse break up adjusted).

Through the CNBC app

[ad_2]

Source link