[ad_1]

Why VCs Are All the time ‘Very Excited’ About Your Progress However That Doesn’t Imply Something Till They Make an Supply

My job as an early stage investor contains translation providers, particularly serving to startup founders take what they’re listening to from potential buyers and offering a learn on whether or not that VC is definitely able to make a suggestion. Very often a CEO will share all types of constructive feedback and reward they heard from an investor, and I’ll remind them these statements aren’t termsheets. Merely put, solely a termsheet is a termsheet.

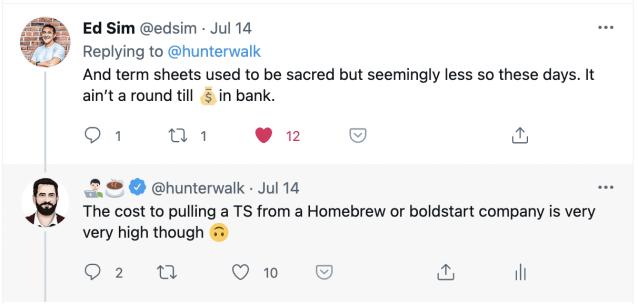

This reminder tweet set off just a few good dialogue threads that I wished to seize and increase upon right here.

Even skilled founders get ‘completely satisfied ears,’ not simply first time founders

I undoubtedly don’t blame founders for underestimating the gap between enthusiasm and a concrete dedication. VCs stay in that world and have repeated expertise. To the extent you belief your present buyers’ suggestions, you need to *actually* belief them in terms of primary fundraising recommendation. Observe: I perceive that there are causes to imagine your buyers are providing you with recommendation primarily based on their pursuits, not yours, however let me inform you, for one of the best VCs this isn’t the case. That’s to not say we’re all the time appropriate, however I’ll particularly inform a founder ‘and now I’m placing on my Homebrew hat’ when I’ve a POV that’s knowledgeable by my very own wants as their capital companion versus what I typically suppose ought to be the corporate’s technique. And I don’t take paths off the desk for dialogue that wouldn’t essentially be my most well-liked selection.

Others VCs undoubtedly know what I’m speaking about

Everybody has skilled a termsheet that got here with hidden surprises

Variations between the verbal provide and the offered termsheet; unacceptable clauses added; plenty of noncommittal language ‘pending due diligence’ and many others. All of us have tales of a termsheet that didn’t pan out — both it by no means arrived even after it was promised. Or it was pulled for no purpose. Or the investor didn’t have the cash to shut the dedication. And so forth. This hardly ever happens with established buyers, as a result of they know breaking their phrase is a status killer round our neighborhood. However it nonetheless does.

One of many advantages of working with somebody like us, or Ed Sim at Boldstart, or considered one of dozens of different companies I’d suggest, is that you’ve got some insurance coverage towards new buyers fucking round.

Are VCs being duplicitous by all the time being ‘excited?’

I worth coinvestors who run fast, direct processes with our founders, however I count on a specific amount of curiosity that doesn’t convert, particularly early in a course of. Forward of getting to decide, it’s all the time within the curiosity of an investor to remain within the recreation. This isn’t distinctive to the dynamics of fundraising, however a ton of individual to individual interactions. Whether or not it’s a hiring supervisor holding some candidates at bay whereas they proceed interviewing. Or just me telling somebody I’ll “attempt to attend their afternoon BBQ” versus simply saying no instantly. I don’t typically maintain any unwell will in the direction of a lot of these responses, particularly when it’s forward of, or throughout, a primary assembly with a founder.

Can somebody develop a status for being a Mr or Ms Possibly or overpromising and underdelivering? Certain. Satya and I’ve an inventory in our heads of GPs who we expect do that and assist our founders handle these conversations accordingly. However I actually don’t suppose it’s outright duplicitousness, simply the inducement hole between two events: a founder desires to boost a spherical inside a sure timeframe and align all bidders, whereas an investor typically desires as a lot info as attainable and barring excessive conviction or a forcing perform, will typically transfer slower than the founder. The phases of fundraising, learn how to get to a primary time period sheet, and what to do when you’ve acquired an preliminary provide might be a weblog collection of its personal.

However finish of the day, in the event you screw a founder, they’ll always remember

Addendum: When is a verbal or e-mail provide nearly as good as a termsheet?

My buddies Keith (Founders Fund) and Sam (Gradual) identified that founders can depend on their gives with out it being in a proper termsheet. I agree with Keith that an e-mail from a Managing Associate at a Tier 1 fund with all main time period elements written out is 99% nearly as good as a termsheet. I don’t like verbals solely — there’s an excessive amount of potential for confusion is what was mentioned, even in good religion conversations. The very best follow I’ve seen is follow-up your name with an e-mail that claims one thing like, “per our dialogue, we’re thrilled to supply ….” and embody the main phrases like Keith suggests.

When would I favor a termsheet to an e-mail, even with a Tier 1 fund?

A. When it’s a junior companion. Sorry, however in the event you’re simply getting your ft moist at a fund, I need to know that there’s a managing/senior companion behind the provide.

B. When a founder goes to cease most of their different conversations on account of the provide. Once more, simply good hygiene to have a termsheet in hand earlier than you begin gradual rolling/canceling/opting out of different conferences. It’s firm particular too. After I imagine a startup is a slamdunk in its funding, we’ll use the primary acceptable termsheet to remove 75% or extra of the open conversations and actually slender all the way down to a handful of companies the crew is contemplating.

C. When there’s one thing non-standard the founders and GP have agreed to exterior of the first phrases Keith mentions. This might embody something round board seats, secondary gross sales, and so forth. Once more, not as a result of I don’t belief the GP however slightly as a result of it’s useful to see it spelled out in authorized language slightly than short-hand intent. Possibly in case your GP went to regulation college (once more, hello Keith), I’ll be comfortable with simply the e-mail and its phrasing.

[ad_2]

Source link