[ad_1]

Click on right here to get a PDF of this submit

The costliest inventory per share each publicly traded of all time is the Berkshire Hathaway A shares (BRK. A) that traded for $445,000 a share on Might 7, 2021 on the New York Inventory Change (NYSE).

That is the New England textile firm that Warren Buffett beginning shopping for at $7.60 in 1962. The Buffett partnership’s common share buy value was $14.86 as Warren Buffett took management of the Berkshire Hathaway firm in 1965.

After Warren Buffett took over the corporate he slowly transformed it to a company conglomerate that used its insurance coverage firm float to amass different nice money flowing corporations for many years. Berkshire Hathaway is a portfolio of corporations chosen to personal in full by Buffett and it additionally holds Buffett’s portfolio of shares in publicly traded corporations he purchased at an important worth for future money flows.

The rationale that the Berkshire Hathaway inventory value is so excessive is that Warren Buffet by no means wished to separate the shares as a result of he most popular having long run traders maintain the shares and never short-term merchants and speculators. Excessive inventory costs make it tough to actively commerce.

Berkshire Hathaway did lastly do a partial inventory cut up to create Class B shares (BRK.B) in 1996. By means of a Unit Funding Belief they created the ticker image BRK.B and stored the per-share worth of the decrease priced shares to roughly 1⁄30 of the unique Class A share (BRK.A) value. BRK.B presently trades at roughly $289 a share.

It is very important perceive that the quantity of shares excellent units the worth of an organization and never the inventory value alone. Berkshire Hathaway (BRK.A) presently has a market cap of $657.2 billon and is the seventh largest firm in the US.

Warren Buffett’s Berkshire Hathaway (BRK.A) is the most costly inventory on this planet presently priced at $435,000 a share.

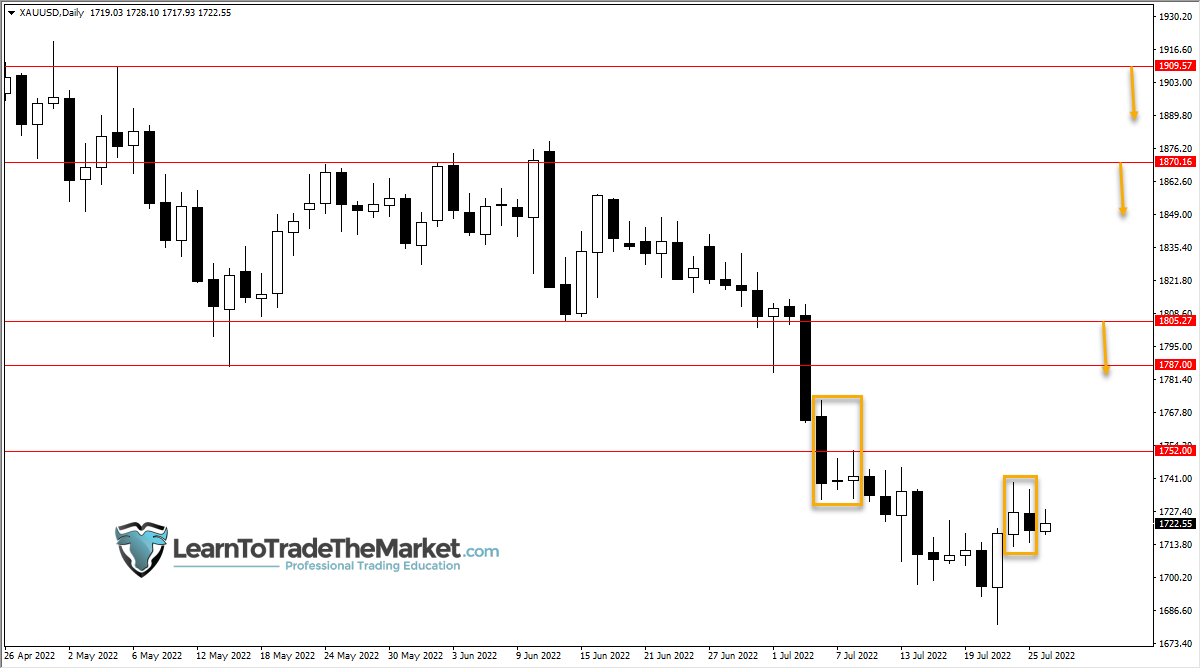

Chart courtesy of TrendSpider.com

[ad_2]

Source link