[ad_1]

Probably the most consequential adjustments within the Center East’s geopolitical map is going on on the water’s edge. Alongside your complete japanese rim of the Mediterranean basin, world and regional actors are partaking in a spate of port capability expansions, new non-public port development, and the sell-off of main state-owned ports that may decide who sits atop the area’s world commerce flows for many years to return. The worldwide competitors to rebuild Beirut’s port is one key puzzle piece on this bigger course of that’s reconfiguring the Levant’s maritime business structure and, as a consequence, the geopolitical contours of the Center East.

The likelihood that the Lebanese authorities might go for China to reconstruct Beirut’s port has raised alarm in Washington and European capitals given China’s already outsized business port presence in Egypt, Israel, and Greece. Elevated Chinese language involvement in Lebanon’s port operations might consolidate Beijing’s maintain over the business connectivity structure of the Levant. Re-orienting world business flows between Europe, the Center East, and Asia in accordance with Beijing’s priorities would make China’s Belt and Street Initiative a dominant organizing precept within the worldwide relations of the Center East. The best technique to offset China’s ambition could also be to facilitate Mediterranean rivals France and Turkey to collectively rebuild Beirut’s port.

On Aug. 4, 2021, France, along side the United Nations, convened “The Convention in Help of the Inhabitants of Lebanon,” a video donors’ convention of 33 nations to boost emergency funds for an economically embattled Lebanon getting ready to monetary collapse. The convention was held on the one-year anniversary of the huge explosion that devastated the port of Beirut, killing a whole lot, injuring 1000’s, and affecting 300,000 Beirut residents. The convention succeeded in elevating $370 million; France, with a pledge of €100 million ($118 million), and Germany, with €40 million ($47 million), had been the main contributions, together with the US, with $100 million. Whereas reflecting Lebanon’s total strategic significance for Paris, Berlin, and Washington, the pledges additionally advance France and Germany’s respective bids to rebuild Beirut’s port and by extension the US’ need to make sure that China doesn’t rebuild it.

Lebanon is in dialogue with 4 international locations in regards to the Beirut port’s reconstruction — China, France, Germany, and Turkey — though different contenders just like the UAE’s DP World have additionally expressed an curiosity within the challenge. Reflecting the urgency to return Beirut’s port to full capability, France’s delivery big CMA CGM made a $400-$600 million proposal again in September 2020 for reconstructing the broken port infrastructure inside a three-year timeframe, together with some capability growth and a digitalization improve.

Irrespective of which proposal is chosen, CMA CGM will play a central function. One of many prime 10 world port operators, the agency is owned by the French-Lebanese Saadé household, whose founder Jacques Saadé was born in Beirut and emigrated to France in 1978. The corporate is the Beirut port’s main operator, dealing with 60% of its quantity, and is probably the most amenable to public-private partnerships with the Lebanese authorities.

In distinction to CMA CGM’s strategy, a consortium led by Hamburg Port Consulting (HPC) proposed an formidable $7.2 billion city renewal plan in April 2021 that might relocate the port and conduct main city renovation tasks, together with the development of residential areas, an out of doors park, and the creation of a brand new seashore on the web site of the destroyed port. Though the German plan requires a complete timeframe three to 5 occasions longer than CMA CGM’s plan, the HPC-led proposal envisions creating 50,000 everlasting jobs. CMA CGM has expressed its willingness to reconstruct the port itself as a part of the German actual property improvement proposal, if invited to take action.

China’s rising strategic dominance over the Levant’s maritime structure

Chinese language development and operation of the Port of Beirut would increase its rising dominance of the business maritime routes throughout the japanese Mediterranean. China already presides over the trans-Mediterranean, business maritime artery that connects Egypt’s ports to the European mainland on the large Chinese language-run trans-shipment port in Piraeus, Greece. Piraeus’s port operator China Ocean Transport Firm (COSCO) gives freight rail service that in the end reaches Austria, the Czech Republic, Germany, and Poland.

China is aiding Egypt to extend the full container capability of its Mediterranean ports to accomplice with Piraeus because the dominant trans-shipment hub within the Mediterranean basin. In a close to mirror picture to Piraeus, China occupies a preeminent place in each the operation of Egypt’s Mediterranean ports and their capability growth. The vast majority of Egypt’s overseas commerce is dealt with by the Alexandria port and its auxiliary El Dekheila port with a mixed container capability of 1.5 million twenty-foot equal items (TEU). The port is run by Hong Kong-based Hutchison Port Holdings, as a three way partnership between Hutchison, the Alexandria Port Authority, and Saudi Al Blagha Holding. Hutchison can be growing a 2-million-TEU Egyptian port on the close by Abu Qir Peninsula that may begin operations in 2022.

The 5.4-million-TEU Suez Canal Container Terminal (SCCT) at East Port Mentioned is owned by Dutch-based APM (55%) and COSCO (20%) with the remaining 25% stake break up amongst Egyptian entities and personal sector individuals. The SCCT companies your complete Suez Canal Financial Zone mega-project, by which China is the most important investor. Though Egypt has efficiently leveraged its relationship with China to draw appreciable investments in transportation infrastructure, Cairo stays eager to diversify its companions to keep away from an inordinate dependency on Beijing. In January 2021, Egypt introduced its intent to accomplice with CMA CGM to develop a further 1.5-million-TEU container facility on the Alexandria port, reflecting the broader strategic partnership between Egypt and France in Africa.

On the Levantine seaboard, Chinese language state-owned Shanghai Worldwide Port Group (SIPG), working with Shanghai Zhenhua Port Equipment Firm, the world’s main provider of heavy loading and logistics gear, constructed a brand new, state-of-the-art non-public port in Israel’s Haifa Bay with a container capability upwards of 1.86 million TEU. Referred to as Bay Port, SIPG is slated to function Israel’s largest container terminal for the subsequent 25 years. With freight rail service to Beit She’an, close to the border crossing with Jordan, China might lengthen the railroad into Jordan, thereby creating multi-modal connectivity with Arab Gulf States. China has additionally constructed a brand new port in Ashdod with further amenities to create a logistics and high-tech improvement hub on the japanese Mediterranean. Moreover, Israel is privatizing its state-owned port of Haifa in October and bids from DP World, India’s Adani Ports, and the UK’s DAO Transport, together with their respective Israeli consortium companions, have been submitted.

Involved with having another, Levantine trans-shipment hub to protect its business connectivity with international locations like Syria and Iraq that might not settle for items shipped by way of Israel, Beijing set its sights on Lebanon’s northern port of Tripoli. China Harbor Engineering Firm (CHEC), which constructed Israel’s new port in Ashdod, upgraded and expanded Tripoli’s port with superior Chinese language cranes, enabling it to deal with 480,000 containers per 12 months. Positioned about 19 miles (30 km) from the Syrian border, Beijing makes use of the Tripoli port to service its Syrian reconstruction effort, which previous to the 2019 U.S. withdrawal, was slated to be a $200 million funding that might allow upwards of 150 Chinese language corporations to function in Syria below profitable contracts.

The port of Tripoli has a couple of third of the capability the Beirut port, however its capability may very well be raised to at the least half of Beirut’s with the set up of further cranes by China. In March 2021, CMA CGM introduced that it had acquired all of the shares of Gulftainer Lebanon, the operator of the Port of Tripoli container terminal. CMA CGM’s Bosphorus Categorical (BEX) line operates a direct hyperlink from Lebanon’s Tripoli port to Shanghai, Ningbo, and different main Chinese language ports. Two weeks previous to CMA CGM’s acquisition of the Tripoli container terminal, the corporate concluded an settlement with Chinese language e-commerce big Alibaba that might see Alibaba’s OneTouch digital platform used for cargo reserving and logistics companies on the BEX line.

Franco-Turkish maritime cooperation to counter-balance China within the Levant

Whereas a Franco-German partnership in rebuilding Beirut’s port stays a chance, CMA CGM additionally has good enterprise causes of its personal to accomplice with Turkey. Given Turkey’s increasing function in Mediterranean-MENA maritime connectivity, Franco-Turkish cooperation can also be probably the most strategic technique to counter-balance China within the japanese Mediterranean.

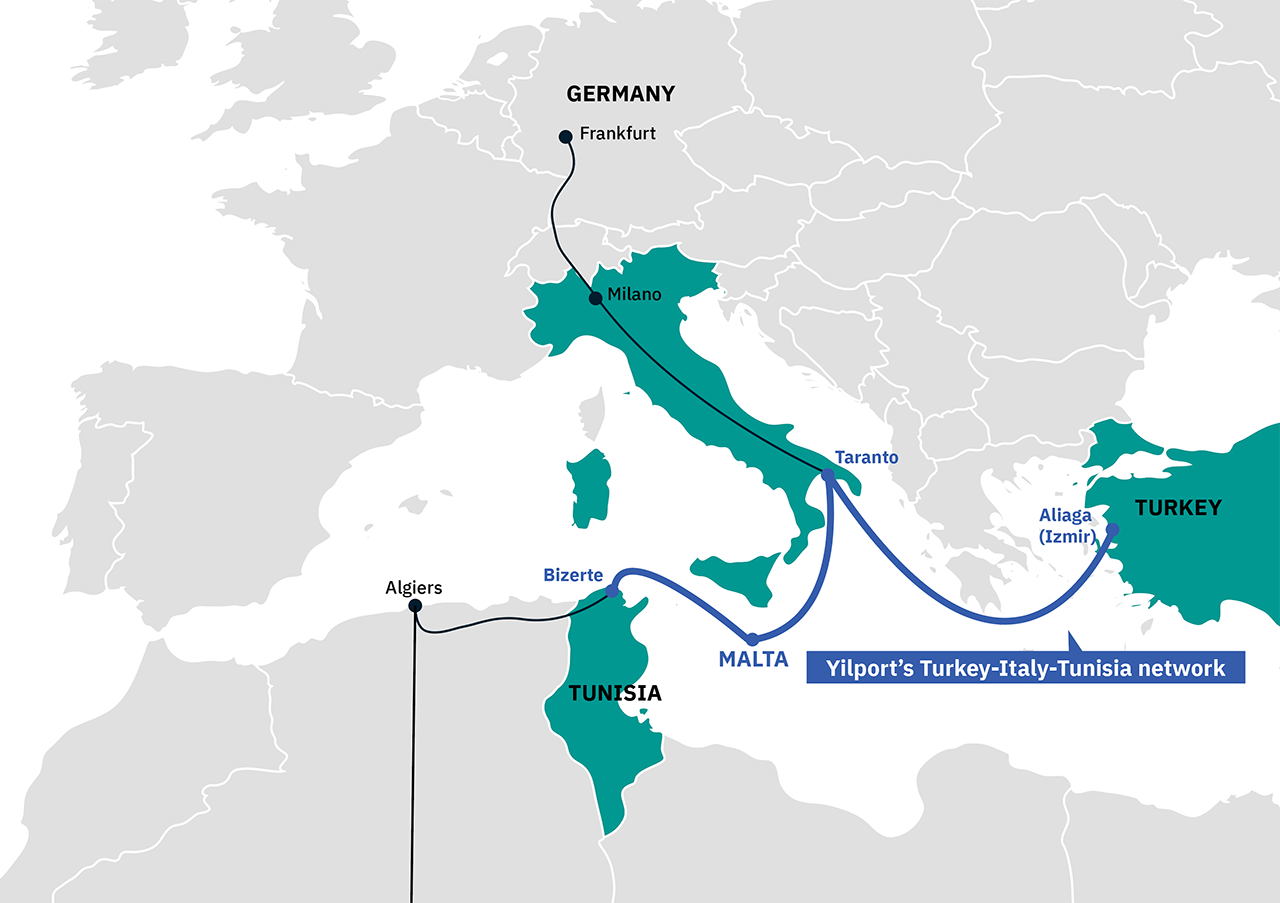

Turkey’s Yilport Holding, a rising terminal operator with world ambitions, established a Turkey-Italy-Tunisia transportation community in 2020 that slices throughout the middle of the Mediterranean, creating an arc of business connectivity from the Maghreb to the broader Black Sea. The Turkey-Italy-Tunisia community’s central hub is Italy’s deep-sea port of Taranto, situated on the nation’s southern tip on the coronary heart of the Mediterranean Sea. The community varieties the first hyperlink in an embryonic central Maghreb-based Europe-Africa hall that makes use of the community’s central node at Taranto, from the place it extends southward to Malta’s Freeport Terminal at Marsaxlokk — additionally owned and operated by Yilport — after which to Tunisia’s port of Bizerte.

Connecting the items of Yilport’s Turkey-Italy-Tunisia community is CMA CGM, by which Yilport Chairman Robert Yüksel Yıldırım is a 24% stakeholder. CMA CGM started service to the Taranto port on July 10, 2020, marking the resumption of container site visitors at Taranto after a five-year hiatus. With a 23.5% enhance within the quantity of cargo dealt with by the port in Q2 2021, Taranto is changing into the geographic crown jewel in CMA CGM’s TURMED service that already hyperlinks Turkey and Tunisia by way of Malta. Eight years earlier than Yilport’s Taranto acquisition, the Turkish port operator acquired a 50% stake in Malta’s Freeport Terminal on the Marsaxlokk port on the southern coast of the island across the similar time that Yıldırım acquired his share in CMA CGM.

Franco-Turkish cooperation involving Yilport and CMA CGM in rebuilding Beirut’s Port would combine the maritime structure of the central and japanese areas of the Mediterranean basin and assist offset China’s rising dominance of the business sea lanes that join the MENA area to Europe and Asia. A trilateral partnership between France, Germany, and Turkey throughout the context of the German proposal for the port’s reconstruction together with main city renovation of the adjoining neighborhoods of Beirut might additionally present a brand new framework for cooperation by which to reset Europe-Turkey relations.

Professor Michaël Tanchum is a non-resident fellow with the Center East Institute’s Economics and Vitality Program. He teaches at Universidad de Navarra and is a senior fellow on the Austrian Institute for European and Safety Coverage (AIES) and visiting fellow within the Africa program on the European Council on Overseas Relations (ECFR). The views expressed on this piece are his personal.

Picture by Xinhua/Wu Lu by way of Getty Photographs

[ad_2]

Source link