[ad_1]

Click on right here to get a PDF of this put up

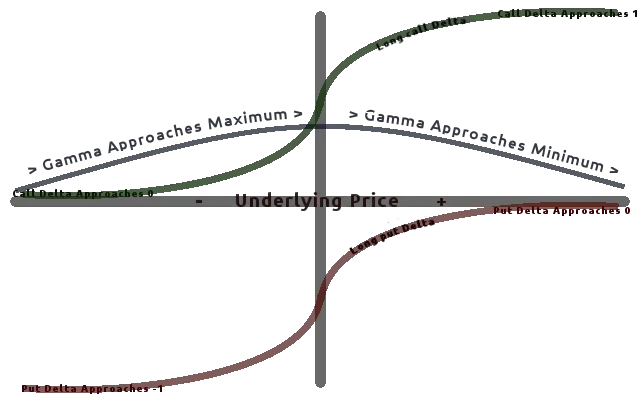

Gamma is the measurement of the speed of change of the delta.

Gamma In Choices Defined

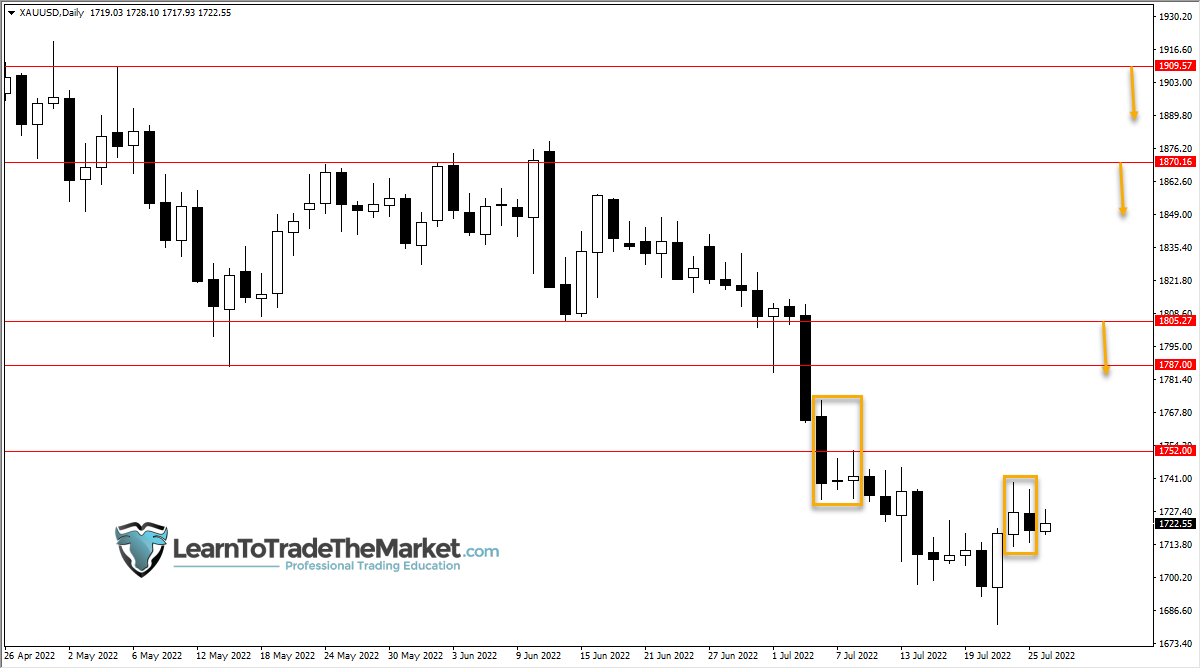

Gamma is the Greek that exhibits how delta will change with the underlier’s worth strikes. It’s the price of change of an possibility’s delta primarily based on a $1.00 transfer in worth of the underlier.

Gamma describes how a lot the choices delta modifications as the worth of the underlying inventory modifications. The choice’s gamma worth is a measurement of the pace of change of the choice’s delta. The gamma worth of an possibility contract is a share and exhibits the change within the delta when there’s a one level transfer within the worth of the underlying inventory. The options gamma worth measures the magnitude and the path of a change within the possibility’s delta.

When an extended name possibility contract has a gamma of 0.10 and a corresponding delta of 0.50, When the underlier goes up $1.00 in worth, that particular possibility could have an possibility Greek delta of 0.60 as one dynamic of its worth motion in correlation with the underlier. It is very important perceive the gamma of a inventory as it may possibly present the chance and advantages of the speed of change as an possibility strikes nearer or farther from being in or out-of-the-money. Quick possibility dangers is without doubt one of the most essential dynamics to contemplate with gamma as the choice worth can transfer strongly towards you shortly throughout a development or hole in worth with the underlier.

Deltas develop and change into larger as worth strikes in favor of your possibility’s strike worth. Choices seize extra intrinsic worth as worth strikes nearer to being in-the-money versus your choices strike worth. Deltas change into smaller as worth strikes away out of your possibility positions strike worth wanted for the choice to go in-the-money. As worth strikes away out of your strike worth wanted for profitability the motion turns into smaller on the choice because the delta declines the gamma additionally declines.

A Gamma scalper of choices is just making an attempt to purchase an out-of-the-money possibility with nothing however time worth and a really low delta and revenue by the choice delta increasing and growing in worth. An out-of- the-money possibility with little or no premium worth can go up in worth as the percentages of it going in-the-money will increase and the delta seize quickly expands.

A Gamma scalper will purchase an possibility with solely Theta worth and revenue from the gamma of a quickly growing delta. All these trades normally have decrease win percentages however will be worthwhile with wins which are 100% or extra of worth worth. The important thing with a majority of these trades which many new possibility merchants love is to commerce them with a small quantity of buying and selling capital. 0.25% or 0.5% of complete buying and selling capital in danger is an effective place dimension for a majority of these excessive reward however low likelihood of success trades. A gamma scalper doesn’t want his choice to go in-the-money to be worthwhile, he solely wants the percentages of it going into the cash to extend so he can promote it for a revenue.

Advantages of Gamma

Gamma will be most worthwhile for lengthy possibility trades as it may possibly develop earnings quick when an out-of-the-money possibility will get near being in-the-money. This may trigger triple digit good points in possibility worth on the lengthy facet. Losses additionally get smaller as an possibility strikes farther away from being in-the-money to create a positive danger/reward ratio. Gamma will enhance till an possibility goes deep-in-the-money with a delta at 1.00. The perfect lengthy possibility gamma commerce is a far-out-of-the-money possibility turning into a deep-in-the-money possibility that maximizes good points.

Quick Choices Gamma Danger

Gamma presents the only largest danger to possibility sellers because the try to jot down choices for the small acquire from theta can result in huge losses from gamma, particularly for brief unhedged possibility performs.

Choices Expiration and Gamma

The chance to lengthy possibility gamma merchants is proscribed to the worth of the choice contract whereas the upside revenue potential is theoretically limitless. The utmost danger on the lengthy facet is that the choice contract turns into nugatory on expiration. The utmost danger for an possibility dealer writing contracts quick is theoretically limitless with no hedge and the first danger is the gamma rising exponentially.

The gamma curve plunges as expiration approaches as the percentages of expiring in-the-money drops to decrease possibilities. As the percentages of delta growth declines gamma declines together with it. Gamma growth is nice for possibility patrons however may cause possibility sellers giant losses. Gamma progress can flip a shedding lengthy possibility commerce right into a winner shortly and likewise flip a successful quick possibility commerce right into a loser simply as fast.

I created my Choices 101 eCourse to offer a brand new possibility merchants a shortcut to a fast and simple approach to learn the way inventory choices work.

[ad_2]

Source link