[ad_1]

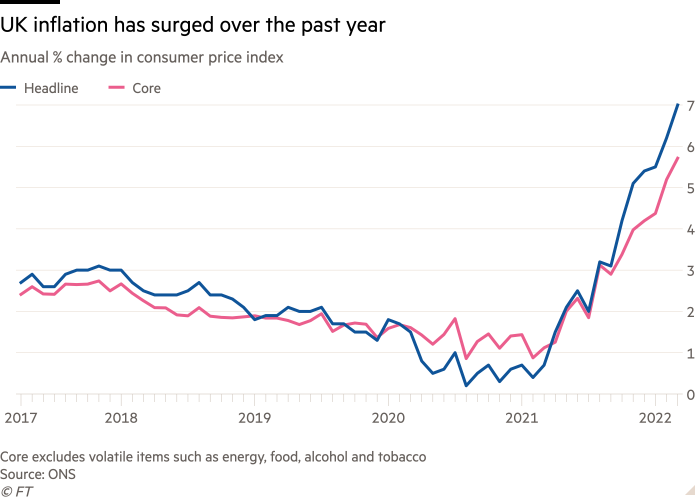

The danger of a chronic interval of stagflation within the UK has elevated after client costs surged greater than anticipated whereas financial progress slowed to a crawl.

Current official and casual financial knowledge have fallen in need of analysts’ expectations, prompting many to warn about stagflation and even an financial contraction within the second quarter of this 12 months.

It comes as some consultants say the federal government has not carried out sufficient to assist households with the cost-of-living disaster ensuing from hovering client worth inflation. Opposition events in parliament have additionally accused chancellor Rishi Sunak of offering insufficient assist to Britons grappling with rising power and meals payments.

Stagflation, which refers to gradual progress in gross home product coupled to excessive inflation, is a comparatively uncommon financial state of affairs that places nice pressure on customers and companies.

Final week, official knowledge confirmed that client costs elevated at an annual price of seven per cent in March, the quickest tempo since 1992. In contrast, progress in gross home product slowed to only 0.1 per cent in February, and actual wages, adjusted for inflation, contracted by 1 per cent.

The figures “spotlight the danger of a stagflation-like episode for the UK economic system”, mentioned Paul Hollingsworth, economist on the consultancy BNP Paribas Markets 360.

Ed Monk, affiliate director on the funding administration firm Constancy Worldwide, mentioned: “The spectre of stagflation stalks the UK economic system.”

Final month the Workplace for Finances Accountability, the UK fiscal watchdog, predicted this 12 months would mark the most important squeeze on family actual incomes since data started within the Fifties.

Close to real-time casual knowledge spotlight how customers are tightening their belts amid the price of residing crunch.

Journeys to UK retail and leisure venues, tracked by Google Mobility Knowledge, have flatlined since mid-February. In mid-April, client confidence was down in contrast with final month, based on every day figures produced by Morning Seek the advice of.

Within the first week of April, spending on credit score and debit playing cards for so-called delayable items, akin to clothes and furnishings, was nonetheless greater than 10 per cent under ranges recorded earlier than the coronavirus pandemic, Financial institution of England knowledge confirmed. That is regardless of not being adjusted for inflation.

Most economists count on inflation to rise greater than 8 per cent within the second quarter, following April’s enhance within the power worth cap for households set by the business regulator, and presumably go greater when the ceiling is revised once more in October.

James Smith, economist at ING, forecast the economic system will contract by 0.2 per cent to 0.3 per cent within the second quarter due to the squeeze on family incomes and falling output within the well being sector owing to decreased Covid-19 vaccinations.

Samuel Tombs, economist at Pantheon Macroeconomics, predicts a slightly bigger contraction and expects the economic system on the finish of the 12 months to be solely 0.5 per cent bigger than in February.

“With the economic system already near flatlining, it could not take a lot to provide a month or two of falling output because the squeeze on family actual incomes intensifies,” mentioned Ruth Gregory, economist at Capital Economics.

Thomas Pugh, economist on the consultancy RSM UK, raised the potential of the economic system falling right into a recession — outlined as two consecutive quarters of contraction.

“With progress forecast to common simply 0.1 per cent in every of the remaining three quarters of this 12 months, it could not take a lot of an increase in oil costs or a disruption in provide chains to push the UK into recession,” he mentioned.

This might imply much more ache for customers. Joanna Elson, chief govt of the charity Cash Recommendation Belief, mentioned one in eight UK adults reported having already gone with out heating, water or electrical energy prior to now three months.

On the finish of March, about 9 in 10 adults mentioned their price of residing had elevated, knowledge from an ONS survey confirmed, with about half decreasing spending on non-essentials or chopping power use at dwelling.

The autumn in actual wages may depart the common UK family about £900 worse off this 12 months, based on calculations by Jake Finney, economist on the consultancy PwC. The bottom earners may see their incomes fall by as a lot as £1,300.

Financial savings amassed in the course of the pandemic ought to assist restrict the blow, however these are concentrated among the many richer households, “and authorities intervention to assist households with little or no financial savings has been comparatively restricted thus far”, mentioned Sandra Horsfield, economist at Investec.

The “at the moment sturdy” labour market may assist mitigate the financial slowdown, mentioned Silvia Dall’Angelo, economist on the funding administration firm Federated Hermes.

Nonetheless, she added that employment progress was already slowing and regardless of Sunak asserting some modest fiscal easing in latest months, “the fiscal stance for this 12 months is restrictive total”.

Many corporations are additionally scuffling with rising prices and waning demand for his or her items and providers. Enter costs for companies rose by an annual price of 19 per cent in March, ONS knowledge confirmed, within the highest month-to-month enhance since data started 20 years in the past.

Martin McTague, nationwide chair of the Federation of Small Companies, a foyer group, mentioned the upper tempo of enter worth progress in contrast with client worth inflation reveals “how small enterprise homeowners are taking the hit instantly — in a variety of instances, decreasing their take-home pay or scaling again funding and enlargement relatively than passing on greater prices to clients”.

Greater than 4 in 5 managers don’t assume the federal government has gone far sufficient to assist UK companies with rising prices, based on analysis by the Chartered Administration Institute, knowledgeable physique.

Anthony Painter, CMI director of coverage and exterior affairs, mentioned companies have been being squeezed as “they face a possible downtick in wider client confidence, and better costs for supplies, provide chain points and better manufacturing prices”.

Sarah Seymour, proprietor of London-based Love Absolute Skincare, a magnificence merchandise firm, mentioned its gross sales have been being hit by individuals having “much less cash of their pockets”.

“Typically no cash in any respect has are available in,” she added. “The battle to outlive for micro companies like mine is actual.”

[ad_2]

Source link